While I am still a newbie in the cryptosphere, I’ve been around the sun more than most, and have taken the time to study the nooks and crannies of science, history, social policy, and psychology that contribute to what may be a different take on issues like these. I may not be telling this audience anything new, but the bulk of the population is yet unaware of what distinguishes the cryptos in a historical and social context, nor the forces that are driving the dramatic rise in price.

“Warnings” from Goldman Sachs predicting a downturn in bitcoin prices, along with comments from the likes of Mark Cuban about upcoming “bubble” events, show no distinction between bitcoin, ethereum, etc., and the current money instruments of which we are all familiar. In Goldman Sachs’ case, such “blending” is to be expected, as it gives more “weight” to their opinion by those who invest with them.

Just what they want, a captive investor audience.

Natural News Comes Out of Left Field

This is all intentional; no mistakes here.

The bankers’ objective would be to keep the masses, especially Americans, on the plantation for as long as they can, doing their best to manipulate or control perceptions about cryptocurrencies before they make things even more embarrassing for banking. Fewer of the masses moving into the CryptoSphere makes the blockchain clearer for those who have larger hoards of money and can snap up the limited supply. The falling value, hyper-inflation prone, bail-in able, corporate-controlled “fiat” currency would be left for the rest of us to work as it was designed.

There is a very profound document available on the internet that is worth reading, titled, Silent Weapons for Quiet Wars. It was published before bitcoin was a gleam in Satoshi Nakamoto’s eye. So there is no mention of the scenario that we’re presently facing in the paper. However, this is, by all means, a quiet war.

You can listen to a reading of the document here. It is well worth the time to read or listen.

To Think ‘Investment’ Only Would be to Limit

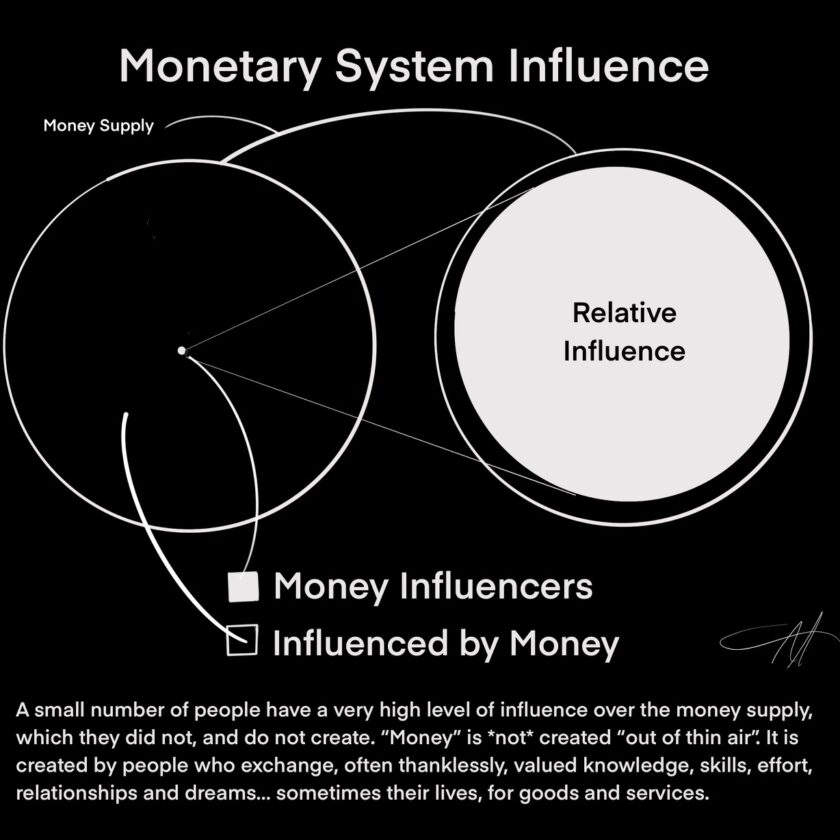

Bitcoin and the emerging alt-coins that are following, are not “money” in the context that each of these pundits and experts suggest, for the simple reason that they are not owned, manipulated or controlled by the entity that owns, manipulates and controls most currencies of the world. Note that I inferred a single entity manipulating and controlling most of the currencies around the world. It may be hard to believe, but manipulation and control has been so effective and complete, that we have literally had nothing to compare monetary performance or expectations against.

Bitcoin is showing up the system, and the system’s manipulators, for what said system is: a very effective means of social and psychological control. It has effectively taken the perception of value from the domain of the individual.

The price and popularity of bitcoin and its progeny is rising because they protect something that money, as we have known and experienced it, was designed to take away; our own *sense* of worth.

Unto itself, money has no value, and is therefore meaningless. The value that money has is what we have collectively given it, with a little help from the manipulators who control education, science, government and religions, whose “god” in each case, is the pursuit money, not in solving the problems we have created.

If you want evidence of money’s intrinsic meaninglessness, look at how much is thrown at people who influence public opinion toward meaningless and/or destructive attitudes, beliefs, and behaviors. Look at how difficult it is to raise money to restore healthy water to our cities and rivers, but a single basketball or football player can get $100 million for playing with a ball.

If you want evidence of money’s intrinsic meaninglessness, look at how much is thrown at people who influence public opinion toward meaningless and/or destructive attitudes, beliefs, and behaviors. Look at how difficult it is to raise money to restore healthy water to our cities and rivers, but a single basketball or football player can get $100 million for playing with a ball.

The current money system owners need the masses to think that there’s no difference between what bitcoin et. al. are, and the money we already have. However, the difference is getting too hard not to notice, and for people to start asking questions about what this “new bitcoin thing” is. As such, they need to keep people wary of stepping in, and thinking that the present money and money changers (including the politicians that they own), are our friends and servants.

This video, which is excerpted from an interview with Dutch banking whistle blower, Ronald Bernard, puts it in very clear perspective. It is a shame only 125,000 people have watched it so far.

https://www.youtube.com/watch?v=5pXKrWj9ZuE

I produced and uploaded this video just prior to seeing the one above.

https://www.youtube.com/watch?v=XgRTZjiaZnE

So the point of this entire point that we have reached in human history is about much, much more than money. We have an opportunity to change the fundamental nature of our society once we see the artificial structures that have so effectively controlled the masses for so long.

I promise to post more often.